The Income Tax regime in India is governed by The Income Tax Act, 1961. The mechanisms for tax collection works primarily on self-assessment basis i.e., the government provides the opportunity to the taxpayers to declare the income earned by them and tax payable thereon. The information submitted by the Taxpayer is then cross checked by the government through various data sources and tools like statement of Tax Deducted at Source (TDS), statement of Tax Collected at Source (TCS), Annual Information Statement (AIS) etc and any discrepancies are then intimated to the taxpayer for further scrutiny.

Under The Income Tax Act, 1961 Taxpayers are required to submit the above information annually. The period for such reporting is called a “

Previous Year.” Each Previous Year begins on

01st April of each year and ends on 31st March of the subsequent year (Commonly also known as

Financial Year). The reporting for each previous year is to be done in the subsequent financial year which is known as “

Assessment Year”. For Example, for the period from 01st-April-2023 to 31st-March-2024 reporting will be done in the period 01st-April-2024 to 31st-March-2025, here the Previous Year is 2023-24 and the Assessment Year is 2024-25.

| Note: A Taxpayer under Income tax Act,1961 is known as an “Assessee”. |

What is an ITR?

The annual reporting of the income and the taxes payable thereon is done by submitting predefined forms with the Income Department known as

Income Tax Return or ITR.

There are various forms which cover the following income:

- Salary Income earned by an employee.

- Income from any business or profession

- Rental Income or income under the head house property

- Income under head capital gains

- Other sources Income such as dividend, interest on deposits, royalty, winning lotteries, etc.

Depending on the nature of income as specified above (including various permutations & combinations thereof), the type of Taxpayer (i.e., Individual, Domestic Company, Foreign Company, Trust etc.,) and the residential status (Resident/ Non-Resident), each taxpayer needs to file a different ITR form. Illustrated below are the ITR Forms:

| Individuals & HUF (Hindu Undivided Family) |

Other |

ITR-1 (SAHAJ-1): This form is applicable only for a Resident Individual having Total Income up to INR 50,00,000 and having incomes only from below sources:

A. Salary / Pension

B. One House Property

C. Other sources (Interest Family Pension, Dividend etc.)

D. Agricultural Income up to INR 5,000 |

ITR-5: This form is to be filed by the following Taxpayers.

A. Firm

B. Limited Liability Partnership (LLP)

C. Association of Persons (AOP)

D. Body of Individuals (BOI)

E. Artificial Juridical Person (AJP)

F. Cooperative Society

G. Local Authority referred to in clause (vi) of Section 2(31)

H. Estate of Deceased Person

I. Estate of an Insolvent

J. Society registered under Societies Registration Act, 1860 or under any other law of any State.

K. Business Trust referred to in Section 139(4E)

L. Investments Fund referred to in Section 139(4F)

|

ITR-2: Applicable for Individual and HUF both having incomes only from below sources:

A. Person Who is not eligible for filing ITR-1 due to other criteria Like being a director in any company, has any asset located outside India, person in whose case payment or deduction of tax has been deferred on ESOP, Income more than INR 50,00,000, Person is Not Ordinarily Resident (NOR)

B. Not having Income under the head Profits and Gains of profession or business |

ITR-3: Applicable for Individual and HUF both having incomes only from below sources:

A. Income under the head Profits and Gains of Profession or Business

B. Person not eligible for filing ITR-1, ITR-2 or ITR-4

|

ITR-6: This form is to be filed by the following Taxpayers:

A. Body corporate incorporated by or under the laws of country outside India.

B. Indian Company |

ITR-4 (SUGAM) – Applicable for Resident Individual (including Resident but, HUF and Firm (other than LLP) with income up to rupees 50 lakh and having income from any of the following sources:

A. Salary / Pension

B. One House Property

C. Having income from Business or Profession which is computed on a presumptive basis (u/s 44AD / 44ADA / 44AE)

D. Other sources (Interest, Family Pension, Dividend etc.)

E. Agricultural Income up to INR 5,000 |

ITR-7: This form is to be filed by the following Taxpayers.

A. 139(4A) – Income derived from Property held under Trust wholly / in part for charitable or religious purposes.

B. 139(4B) –Chief Executive Officer of every Political Party

C. 139(4C) – Various entities like Research Association, News Agency, etc. mentioned in Section 10

D. 139(4D) – University, College or other Institution referred in Section 35 |

Requirements for Filing ITR

As per section 139, Following are the conditions where filing of ITR is mandatory.

1. In case of Company or Firm registered in India – mandatorily required irrespective of income.

2. Other than Company or Firm (Individual/HUF/Trust) – if any of the below conditions are met:

- If the total income (without giving effect to Section-80 or Section-54 deductions or Section-10 exemptions) in a financial year/previous year exceeded the maximum amount which is not chargeable to income-tax.

- The person incurs an expenditure of INR 1,00,000 or more towards consumption of electricity in the previous year.

- The person has incurred expenditure of a sum or aggregate of the amounts exceeding INR 2,00,000 for himself or any other person for travel to a foreign country.

- The person is the holder of a credit card, not being an "add-on" card, issued by any bank or institution.

- The Person is a member of a club where entrance fee charged is INR 25,000 or more.

- The person has deposited a sum or aggregate of sums exceeding INR 1 Crore (INR 10 Mn) in one or more current accounts maintained with a co-operative bank or a banking company.

Verification of ITR

A return is considered to be valid only if it is verified by the Taxpayer, otherwise it is treated as if no return was filed (treated as Defective Return under Section 139(9)). The Taxpayer gets 30 Days from the filing of Income Tax return to verify the ITR.

Following are the ways to verify a return:

1. Individual/HUF:

- E-Verification – Through OTP on Adhaar linked Mobile Number or OTP on Mobile Number linked with Bank Account.

- Physical Verification – Signed ITR acknowledgement (Form ITR-V) needs to be sent to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500” through Courier.

2. Other Taxpayer (Company, Firm, Trusts): Only through E-verification using Digital Signing Certificates (DSC) of the Authorised Representative.

Due Date of Filing ITR

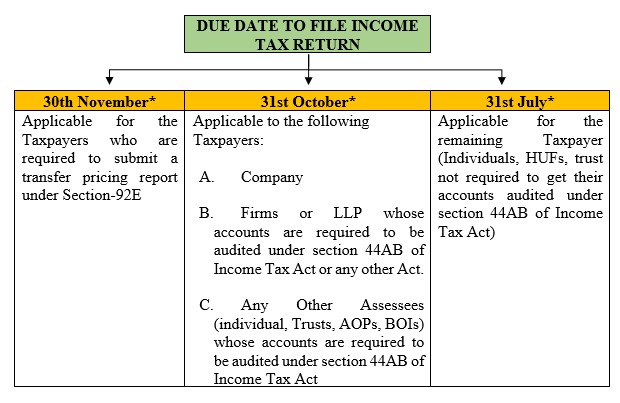

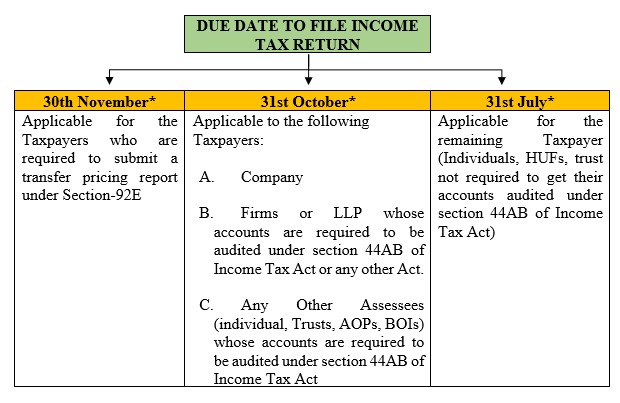

As per Section 139(1) of The Income Tax Act, 2013 the due date for filing the Income Tax Return depends on the type of Assessee (Individual, Company, Firm, Trust etc) and the turnover of such Assessee. The due dates for filing ITR are as follows:

* These dates are of the relevant Assessment year. For Example:

- The due date for Filing of ITR by a salaried individual for FY 2023-24 is 31-July-2024

- The due date for Filing of ITR by a Company for FY 2023-24 is 31-October-2024

- The due date for Filing of ITR by a Company required to file a transfer pricing report for FY 2023-24 is 30-November-2024

Remedies for Delay in Filing ITR

Each Taxpayer needs to file the income tax returns as per the timelines explained above. However, in case the taxpayer does not file the income tax returns on time, following are the options available to file late income tax returns:

1. Belated Return: As per Section 139(4), any person who has not furnished a return within the time allowed to him may furnish the return for any previous year (financial year) at any time before three months prior to the end of the relevant assessment year i.e. till 31st December of the Assessment Year. For Example, if an individual has not filed ITR of FY 2023-24 up to 31-July-2024, he can file the ITR till 31st December 2024.

However, for filing such late/belated return late filing fees of INR 5,000 (Rs. 1,000 if total income is less than INR 5,00,000) under section 234F needs to be paid in addition to the interest under section 234A, 234B, 234C and section 139(8) (if any).

| Note: A Loss Return i.e., an ITR in which the Taxpayer has shown Business loss or loss under the head Capital Gains the said loss cannot be carried forward if the ITR is filed late. However, the loss under the head house property can be carried forward. |

2. Updated Return: This is a new provision which has been introduced in budget for the year 2022.

- If a Taxpayer fails to file the return of income tax even the period allowed for the belated return or even if he has filed the return on time, he can file an updated ITR in the form ITR-U.

- This updated return can be filed within 24 Months at any time from the end of the relevant assessment year i.e., 3 years from the end of the Financial Year. For Example, if a company has not filed the ITR for FY 2023-24 till 31st December 2024, it can file the ITR till 31st March 2027.

- However, the above provisions are not applicable under any of the following circumstances:

i. The updated ITR filed is a return of a loss; or

ii. The updated ITR has the effect of decreasing the total tax liability determined.

iii. The updated ITR results in refund or increases the refund due on the return filed on a timely basis.

iv. An updated return has already been filed by the Taxpayer i.e., an updated ITR is allowed to be filed only once in a lifetime.

v. Any proceeding for assessment or reassessment has been completed for the respective financial year.

vi. A Search has been initiated under section 132.

vii. A survey has been conducted under section 133A.

3. Condonation of Delay in Filing of ITR: If the Taxpayer fails to file the ITR even after the timeline for the updates refund, then he has to file a separate application to allow him to file the ITR. However, this facility is available up to maximum 6 years from the end of the assessment year i.e., 7 years from the end of the Financial Year. For example, for FY 2023-24, the Condonation application can be made maximum till 31/03/2031.

A. under Section 119 (2) income-tax authorities can admit an application or claim for any exemption, deduction, refund, or any other relief till the expiry of the period as specified above. The power of acceptance or rejection of an application is vested according to the rank as below:

i. Principal Commissioner or Commissioner of Income Tax – Tax claims Less Than INR 10 Lakh (INR 1 Mn)

ii. Principal Chief Commissioner or Chief Commissioner of Income Tax – Claims between INR 10 Lakh - INR 50 Lakh (INR 1 Mn to 5 Mn)

iii. Central Board of Direct Taxes – Tax claims More than INR 50 Lakh (INR 5 Mn).

B. The process to claim an income tax refund is lengthy and may have litigation with the income tax authority in the current facts of the matter.

C. Condonation for application is accepted only if the delay in filing ITR was due to situation which were out of control of the taxpayer and which caused Genuine Hardship to the taxpayer (For Ex. Death of spouse, parents or children in case of individual taxpayer, Liquidation of the company, death of Authorised Director of a Company or Managing Partner of a Firm). Genuine hardship is a subjective matter and will depend on a case-to-case basis and shall be decided by the Authority to which the application is made.

D. The Taxpayer requires to follow the steps below:

i. The Taxpayer shall submit the application to the respective authority as described above for condonation of a delay. The application shall be supported with the document which will justify the condonation of the delay, and the related amount involved.

| Note: In case of a condonation application where the filing of ITR results in a refund, the taxpayer needs to comply with the following Mandatory conditions: |

a. The income of the Taxpayer is not assessable in the hands of any other taxpayer under any of the provisions of the Act.

b. No interest will be admissible on belated claim of refunds.

c. The refund has arisen as a result of excess tax deducted /collected at source and/or excess advance tax payment and/or excess payment of self-assessment tax as per the provisions of the Act.

ii. Based on the documents and representation, the Authority shall pass the order either allowing the Taxpayer to file the return or rejecting the application.

iii. In the event of receipt of the favorable order on condonation of a delay from the Authority, the assessing officer of Taxpayer can allow the taxpayer to submit the income tax return in India under which the income tax refund (if any) will be claimed.