Under the Fiscal Responsibility and Budget Management Act, 2003, the Central Government, in each financial year presents before both Houses of Parliament the statements for fiscal policy along with the annual financial statement, this commonly referred to as ‘Budget’. This annual activity also includes the notification of various amendments in the taxation laws of the country for the financial year.

The budget for the Fiscal Year 2025-26 was presented on 02nd February 2025. There were various amendments to the taxation laws, Banking and financial sector regulations and the governance policy of the Union Government that aimed to improve the ‘Ease of Business’ policy of the Union Government.

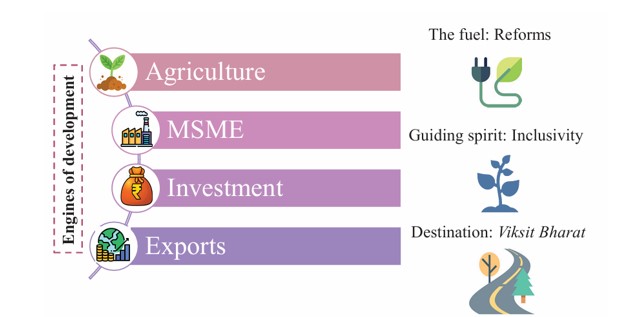

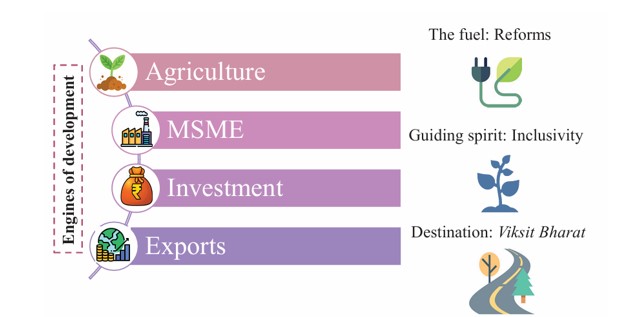

In lines with the vision of

Viksit Bharat, the Hon’ble Finance Minister Nirmala Sitharaman emphasised that budget was formulated with the background that ‘

A country is not just its soil, a country is its people’. The primary focus of the budget, was on

4 engines of development (Agriculture, MSME, Investments, Exports) along with metaphoric

fuel (reforms), guiding spirit

(Inclusivity) that leads to the final destination of

Viksit Bharat. The same is depicted below:

MAJOR SCHEMES FOR THE 4 ENGINES

1. Agriculture

- Prime Minister Dhan-Dhaanya Krishi Yojana - Developing Agri Districts Programme in partnership with the states, covering 100 districts with low productivity, moderate crop intensity and below-average credit parameters, to benefit 1.7 crore farmers.

- The loan limit under the Modified Interest Subvention Scheme to be enhanced from INR 3 lakh to INR 5 lakh for loans taken through the KCC.

- 5-year mission announced to facilitate significant improvements in Cotton Productivity.

- National Mission on High Yielding Seeds to be launched.

- Government to launch a 6-year “Mission for Aatmanirbharta in Pulses” with focus on Tur, Urad and Masoor. NAFED and NCCF to procure these pulses from farmers during the next 4 years.

2. MSME

A. Revision in classification criteria for MSME: The investment and turnover limits for classification of all MSMEs to be enhanced to 2.5 and 2 times respectively.

Amount in INR Crores

| |

Investment

|

Turnover |

| Classification type |

Current |

Revised |

Current |

Revised |

| Micro Enterprises |

1 |

2.5 |

5 |

10 |

| Small Enterprises |

10 |

25 |

50 |

100 |

| Medium Enterprises |

50 |

125 |

250 |

500 |

B. Customized

Credit Cards with

INR 5 lakh limit for micro enterprises registered on Udyam portal, 10 lakh cards to be issued in the first year.

C. Scheme for first time Entrepreneurs: For 5 lakh first-time entrepreneurs, including women, Scheduled Castes and Scheduled Tribes, a new scheme, to be launched, to provide term loans up to INR 2 crore during the next 5 years.

D. Enhancement of credit guarantee cover: below is the summary of credit guarantee limits for MSME Sector.

Amount in INR Crores

| Classification type |

Current |

Revised

|

| Micro and Small Enterprises |

5 |

10 |

| Startups |

10 |

20 |

| Exporter MSMEs |

For Term Loans upto INR 20 Crore |

E. Sector based incentives: Measures will be taken for the below Sectors

- Toy Sector

- Leather Sector

- Food processing

3. Investment

- Infrastructure-related ministries to come up with a 3-year pipeline of projects in PPP mode, States also encouraged. An outlay of INR 1.5 lakh crore proposed for the 50-year interest free loans to states for capital expenditure and incentives for reforms.

- The Shipbuilding Financial Assistance Policy to be revamped. Large ships above a specified size to be included in the infrastructure harmonized master list (HML).

- SWAMIH Fund-2: INR 15,000 crore for expeditious completion of one lakh dwelling units through blended finance.

4. Exports

- An Export Promotion Mission, with sectoral and ministerial targets, driven jointly by the Ministries of Commerce, MSME, and Finance to be set up.

- BharatTradeNet’ (BTN): a digital public infrastructure for international trade will be set-up as a unified platform for trade documentation and financing solutions. Support for integration with Global Supply Chains.

MAJOR REFORMS (FUEL)

- The FDI limit for the insurance sector to be raised from 74% to 100%, for those companies which invest the entire premium in India.

- The Jan Vishwas Bill 2.0 to decriminalize more than 100 provisions in various laws.

- NaBFID to set up a ‘Partial Credit Enhancement Facility’ for corporate bonds for infrastructure.

DIRECT TAX AMENDMENTS

At the Outset, the Finance minister announced that a new Income Tax bill will be introduced. The new Income-Tax Bill to be clear and direct in text so as to make it simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation.

Further, to reduce the compliance burden, promote entrepreneurial spirit and provide tax relief to citizens, the following changes were made:

1. Capital Gains:

- Transfer of ULIPs (not eligible for specified exemption) to be treated as ‘Capital gains.

- Definition of ‘capital asset’ to include securities held by category – I or category – II Alternate Investment Funds regulated by SEBI or IFSCA.

- Definition of ‘virtual digital asset’ (VDA) has been expanded to include any crypto-asset being a digital representation of value that relies on a cryptographically secured distributed ledger or a similar technology to validate and secure transactions, whether or not it is included in the existing definition of VDA .

2. IFSC

A. Extension of sunset dates from

March 31, 2025, to March 31, 2030, for commencement of operations of following IFSC units for availing following exemptions/ deductions:

- income earned by investment division of offshore banking units.

- Royalty, interest income earned by non-residents on lease of aircraft, ship to IFSC units; and - gains on transfer of aircraft, ship by IFSC units.

B. Capital gain income on

transfer of equity shares arising to a non-resident and unit of IFSC engaged in

ship leasing business will be exempt.

C. Dividend income arising to an

IFSC unit engaged in ship leasing from another IFSC unit engaged in

ship leasing business will be exempt.

D. Income of a non-resident on account of transfer of non-deliverable forward contracts or offshore derivative instruments or over-the-counter derivatives, or distribution of income on offshore derivative instruments, entered into with an offshore banking unit of an IFSC is exempt.

E. It is proposed to extend the exemption to income arising from contracts entered with Foreign Portfolio Investors in IFSC.

F. Arrangements for loan or advance, between two group entities where one of the entities is a Finance Company/Finance Unit set-up in IFSC as a global or regional corporate treasury centre so long as the parent/ principal entity of such group is listed on recognized exchange outside India, shall not be treated as dividend income.

G. Proceeds from insurance policy are exempt so far as the annual premium paid or payable is not more than INR 250,000 in case of unit linked insurance policy and INR 500,000 in case of life insurance policy. It is proposed that any sum received on life insurance policy issued by an IFSC insurance office shall be exempt without the above-mentioned maximum premium payable.

H. Provisions for

tax neutral relocation to IFSC are now also

extended to retail mutual fund schemes and Exchange Traded Funds. Further, the sunset date for tax neutral relocation of funds to IFSC has been

extended from March 31, 2025, to March 31, 2030.

3. Individual tax Holders

A. There were no changes made in the Old Income tax regime i.e. the below slab will be applicable with the deductions of 80C (PF, PPF, home loan repayment, Life insurance, children tuition fees etc.,) 80CCD (NPS), HRA deduction will be allowed to be made:

B. The Budget was focused on the

new income tax regime for individual taxpayers as well as HUFs with the below amendments made:

- Tax Rate has been revised to the below tax slab

| Income Slab |

Tax Rate |

| 0-4 lakh rupees |

Nil |

| 4-8 lakh rupees |

5% |

| 8-12 lakh rupees |

10% |

| 12-16 lakh rupees |

15% |

| 16-20 lakh rupees |

20% |

| 20- 24 lakh rupees |

25% |

- Rebate: for the new tax regime, rebate under section 87A, has been increased upto total amount of tax payable with a threshold income of INR 12,00,000 i.e. 100% rebate on tax payable till income of INR 12,00,000.

As per the Budget, there will be an effective tax saving A taxpayer in the new regime with an income of INR 12 lakh will get a benefit of INR 80,000 in tax (which is 100% of tax payable as per existing rates). A person having income of INR 18 lakh will get a benefit of INR 70,000 in tax (30% of tax payable as per existing rates). A person with an income of INR 25 lakh gets a benefit of INR 1,10,000 (25% of his tax payable as per existing rates).

C. Salary income: Above tax slab rates apply in addition to the standard deduction of INR 75,000 in new tax regime i.e. tax liability an individual earning a salary of INR 12,75,000 will be liable to zero tax.

D. Rental Income:

- Presently, the law provides ‘nil’ annual value for two self-occupied house properties, based only on conditions that such house property cannot be occupied due to employment, business or profession carried out at another place.

- It is proposed to treat annual value ‘NIL’ for self-occupied properties where the owner cannot actually occupy the property for any reason (no conditions need to be fulfilled).

E. Withdrawal from National Savings Scheme (NSS): Deposit to NSS made up to March 31, 1992, was deductible in the hands of taxpayer and any withdrawal from such account was taxable. It is proposed to exempt such withdrawals from NSS on or after August 29, 2024.

F. Contribution to National Pension Scheme (NPS) Vatsalya account: Contribution by parent/guardian to the NPS (Vatsalya) account of minor to be allowed as deduction, subject to overall limit of INR 50,000. Partial withdrawal up to 25% of contribution proposed to be exempt Any amount received from NPS Vatsalya account on death of minor to be exempt.

4. Transfer Pricing

A. Block assessment

- Transfer Pricing assessments can be carried out as a block of 3 years (applicable from April 1, 2026).

- ALP determined by the TPO for a given year will apply to similar transactions for the next 2 consecutive years, if the taxpayer exercises this option.

- TPO to confirm the validity of the option within 1 month from the end of month of exercise of option by the taxpayer.

- These provisions do not apply to search cases.

- AO to recompute the income based on the ALP determined by TPO or directions issued by DRP for 2 consecutive years within the specified time.

B. Safe Harbour Rules: Scope of safe harbour rules proposed to be expanded subsequently

5. OTHERS

A. Presumptive taxation for non-residents providing services for Electronic Manufacturing Facilities (EMF)

- Services or technology provided to a resident company establishing or operating an EMF in India.

- 25% of the gross receipts of to be treated as business income.

- No set-off of unabsorbed depreciation or brought forward losses against the presumptive income.

B. Carry forward of losses in case of successions The fresh lease of life for the

accumulated loss of the predecessor entity due to amalgamation, conversion of partnership and proprietorship entities to corporate entities and conversion of companies into limited liability partnerships is curtailed.

Such loss cannot be carried forward for more than 8 years from the assessment year in which such loss was first computed for the predecessor entity. This amendment to be applied to

any amalgamation or business re-organisation effected on or after April 1, 2025. Similar changes are brought in relation to amalgamation of banking companies / banking institutions / certain government companies.

C. Significant Economic Presence: Activities of a non-resident with any person in India confined to

‘purchase of goods in India for the purpose of export’ shall not constitute significant economic presence.

D. Extension for incorporation of eligible start-up: The timeline for incorporation of eligible start-up entities is proposed to be extended

by 5 years up to March 31, 2030.E. Extension of Tonnage Tax Scheme to inland vessels: Benefits of existing Tonnage Tax Scheme extended to

Inland Vessels operated by qualifying shipping companies

to promote inland water transportation.F. Updated ITR

- Under section 139(8A) Time-limit for filing updated return to be increased from 24 months to 48 months from the end of relevant Assessment Year.

- Additional tax payable Under Section 140B is also updated accordingly, depicted as below:

| Where updated return filed within |

Additional tax |

| 12 months from the end of the relevant AY |

25% of aggregate of tax and interest payable |

| 24 months from the end of the relevant AY |

50% of aggregate of tax and interest payable |

| After 24 months but up-to 36 months from end of relevant AY |

60% of aggregate of tax and interest payable |

| After 36 months but up-to 48 months from end of relevant AY |

70% of aggregate of tax and interest payable |

G. Charitable institutions: the validity of regular registrations granted to charitable institutions (having gross total income of INR 5 Crore before exemption) to be extended to 10 years (from existing limit of 5 years)

6. Assessments and Appeals:

- Period of Limitation - The limitation period to exclude period commencing on the date on which the stay was granted and ending on the date on which certified copy of the order is received by the specified authority.

- Seized books of accounts and documents cannot be now retained for a period exceeding one month from the end of the quarter in which the order of assessment or reassessment or re computation is made.

- In cases of multiple searches, the assessment for subsequent search can be made only after completing the assessment for prior search.

- Block assessment order to be passed within 12 months from the end of quarter of last executed authorization for search or requisition.

- Undisclosed income to include ‘virtual digital asset’ effective from 1 February 1, 2025.

7. TAX DEDUCTED AT SOURCE (TDS)/TAX COLLECTED AT SOURCE:

A. Both TDS and TCS were being applied on any transaction relating to sale of goods. To prevent such compliance difficulties,

section 206(1H) has been omitted to remove TCS on such transactions of purchase.B. To reduce compliance burden on the deductor/collector, it was proposed to omit section 206AB and section 206CCA

of the Act. The provisions of the higher TDS & TCS deduction will now apply only in non-PAN cases.C. The below changes were made to rates of TDS/TCS:

| Section |

Nature of payment / income |

Existing rates |

Revised rates |

| 194LBC |

TDS on income in respect of investment in securitization trust |

25% if payee is Individual or HUF and 20% otherwise |

10% |

| 206C(1) |

TCS on

a. timber or any other forest produce (not being tendu leaves) obtained under a forest lease and

b. timber obtained by any mode other than under a forest lease |

2.5% |

2% |

| 206C(1G) |

TCS on remittance under LRS for purpose of education, financed by loan from financial institution |

0.5% (after INR 700,000) |

NIL |

D. The below changes were made to threshold limits of TDS/TCS:

| Section |

Nature of payment / income |

Existing threshold (INR) |

Proposed threshold (INR) |

| 193 |

Interest on securities |

NIL |

10,000 |

| 194 |

Dividend |

5,000 |

10,000 |

| 194A |

Interest (other than interest on securities) payable by banking company / cooperative society / post office

a. Senior citizen

b. others |

50,000

40,000 |

1,00,000

50,000 |

| 194A |

Interest (other than interest on securities) payable by other payers |

5,000 |

10,000 |

| 194B |

Lottery, crossword puzzle, etc. |

10,000 during the year |

10,000 for a single transaction |

| 194BB |

Winnings from horse race |

|

|

| 194D |

Insurance commission |

15,000 |

20,000 |

| 194G |

Commission on sale of lottery tickets |

15,000 |

20,000 |

| 194H |

Commission or brokerage |

15,000 |

20,000 |

| 194-I |

Rent |

240,000 in a financial year |

50,000 in a month or part of the month |

| 194J |

Professional / Technical services |

30,000 |

50,000 |

| 194K |

Income in respect of units |

5,000 |

10,000 |

| 194LA |

Enhanced compensation |

2,50,000 |

5,00,000 |

| 206C(1G) |

TCS on LRS |

7,00,000 |

10,00,000 |

CUSTOM LAWS AMENDMENTS

The changes in the custom laws in the 2025 final budget were focused to support domestic manufacturing and value addition, promote exports, facilitate trade and provide relief to common people. The following changes in the following industries were made:

1. Time limit for finalisation of provisional assessments: Section 18 of the Customs Act is to be amended to provide a structured time

limit of 2 years for finalization of provisional assessments; further extendable up to 1 year on approval of the Principal Commissioner/Commissioner of Customs

2. Post clearance revision on voluntary basis: Section 18A is to be

introduced in the Customs Act, to provide for a facility for importers and exporters for

voluntary revision of the Bill of entry / Shipping bill within the prescribed time and manner. Post revision, importer or exporter shall re-assess the duty and:

- In case of short payment or levy/non-payment or levy, pay the differential duty with interest (without penalty) or

- In case of excess payment, refund of excess duty shall be granted

3. Sunset of the Settlement Commission: Mechanism of Settlement Commission, prescribed under Section 127 of the Customs Act to be

discontinued with effect from April 1, 2025. 4. IGCR ((Import of Goods at Concessional Rate of duty)

- Importers to file statement in Form IGCR-3 on a quarterly basis instead of the present monthly filing

- The time limit for which goods imported under IGCR can be sent to job-workers enhanced from 6 months to 1 year from the date of invoice or electronic waybill

- Time limit for fulfilling end use of the goods extended from 6 months to 1 year

5. Customs- Rate Changes (to be effective from February 2, 2025)

6. The proposed changes in duties of customs aim at rationalizing tariff structure and address issues concerning duty inversion. Key proposals are thus aligned towards:

- Removal of seven (7) Tariff rates. Consequently, the Tariff rates of 25%, 30%, 35%, 40% have been rationalised to 20%, whereas the rates of 150%, 125%, 100% rationalised to 70%. There will remain eight (8) tariff rates including a zero rate

- Levy of only one cess or surcharge on imports. Thereby, exemption is proposed from the levy of SWS on various items, and consequent levy of AIDC is proposed to broadly maintain effective duty incidence

7. Key BCD (Tariff) rate changes:

Chapter / Tariff Heading / Tariff Item

|

Particulars |

Old rate

|

New rate |

| 6401 to 6405 |

Footwear |

35%

|

20%

|

| 7113, 7114 |

Articles of Jewellery, Goldsmiths etc. |

25%

|

20%

|

| 8524 / 8529 |

Open cell for Interactive Flat Panel Display Module with or without touch, Touch Glass Sheet and Touch Sensor PCB for the manufacture of theInteractive Flat Panel Display Module |

15% /10%

|

5%

|

| 8529 |

Inputs and Parts of the Open Cells for use in the manufacture of Television Panels of LED/ LCD TV |

2.50%

|

NIL

|

| 8541 42 00 |

Solar Cell |

25%

|

20%

|

8541 43 00

8541 49 00 |

Solar Module and Other Semi-Conductor device and photovoltaic cells |

40%

|

20%

|

| 8702, 8704 |

Motor vehicles for transport of 10 or more people, Motor vehicles for the transportation of goods |

40%

|

20%

|

| 8703 |

Motor cars and other motor vehicles principally designed for transport of persons and electrically operated vehicle |

125%

|

70%

|

| 8711 |

Motorcycles and cycles fitted with an auxiliary motor with or without sidecar |

100%

|

70%

|

| 9028 30 10 |

Electricity meters for alternating current (Smart meter) |

25%

|

20%

|

| 9401 |

Seats (other than those of heading 9402), whether or not convertible into beds, and parts thereof |

25%

|

20%

|

| 9403 |

Other furniture and parts thereof |

25%

|

20%

|

| 9804 00 00 |

All dutiable goods imported for personal use |

35%

|

20%

|

8. Social Welfare Surcharge on 82 tariff lines that are subject to a cess, exempted.

GST AMENDMENT

Following changes were made in the GST laws

1. Taxability

A.

Section 34(2) of the CGST Act is to be amended to provide that

the supplier cannot reduce tax liability on a credit note, unless the recipient has reversed the corresponding ITCB. Section 12(4) and Section 13(4) of the CGST Act, providing for the time of supply in respect of supply of vouchers, are to be omitted, to align with Circular No. 243/37/2024-GST dated December 31, 2024 (which clarified that transactions in vouchers are not to be treated as ‘supply’ under GST Law)

C. Schedule III of CGST Act is being amended, w.e.f. 01.7.2017 by inserting a new clause (aa) in paragraph 8 of Schedule III of the Central Goods and Services Tax Act, to provide that the

supply of goods warehoused in a Special Economic Zone or in a Free Trade Warehousing Zone to any person before clearance for exports or to the Domestic Tariff Area shall be treated neither as supply of goods nor as supply of services.

2. Input Tax Credit

A. Section 17(5)(d) of the CGST Act is to be amended to replace the phrase ‘plant or machinery’ with the phrase ‘plant and machinery’ retrospectively (effective from July 1, 2017).

An Explanation is to be inserted to provide that the said change shall operate notwithstanding any contrary judgment, decree or order of any court, tribunal or authorityB. Section 2(61) and Section 20 of the CGST Act are to be amended with effect from April 1, 2025, to include ITC of IGST payable under reverse charge, for distribution through the ISD mechanism

3. Pre-deposit

A. Section 107(6) and Section 112(8) of the CGST Act are to be amended to provide for mandatory pre-deposit in cases involving only demand of penalty. Below is the comparison of existing and proposed pre-deposit rates:

| |

Commissioner (Appeals)

|

Appellate Tribunal |

| Penalty levied |

Existing |

Proposed |

Existing |

Proposed |

| Relating to detention/seizure of goods and/or conveyance in transit |

25% |

10% |

Nil |

10% |

| In other cases |

Nil |

10% |

Nil |

10% |

4. Others

A. Section 148A of the CGST Act is to

be introduced to empower the Government to notify specified goods and related persons/class of persons

for implementation of the ‘Track and Trace Mechanism’. The said mechanism shall be based on a

Unique Identification Marking (UIM) which shall be affixed on the said goods or the packages thereof. The specified persons will be required to:

- affix UIM on the specified goods or their packages

- furnish the requisite details as may be prescribed

- furnish the details of machinery used in manufacturing the specified goods

B. Section 122B is to be

inserted to the CGST Act, to provide for penalty

(higher of Rs. 1 lakh or 10% of the tax payable on the goods) in case of non-compliance with the UIM mechanismC. Section 38 of the CGST Act is to be amended to provide for a legal framework in respect of generation of statement containing details of ITC in Form GSTR-2B (to align with the action taken by the taxpayers on the IMS)

D. Section 39 of the CGST Act is to be amended to empower the Government to provide for restrictions and conditions for filing Form GSTR-3B