Financial Audit is an independent examination of the financial statements of a company conducted with objective of expressing an opinion thereon. Audit is a necessity that arises out of the need for raising funding, ensuring compliance with laws and regulations, verification of the transactions undergone by the company.

The Section 139 of the Companies Act, 2013, mandates that every company is required to get their book of accounts audited each fiscal year, in accordance with the recent rules and regulations.

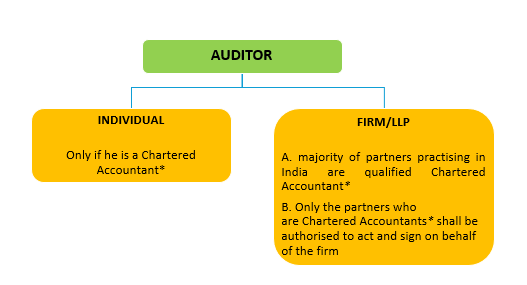

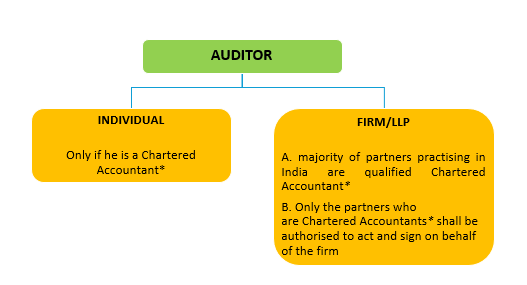

Who Can Be an Auditor (Eligibility)

As per Section 141 of the Companies Act, 2013 following persons can become the auditor of a company.

- An individual, only if he is a Chartered Accountant*

- A partnership firm wherein most partners practising in India are eligible for appointment as aforesaid.

* Chartered Accountant - Stated in clause (b) of sub-section (1) of section 2 of the Chartered Accountants Act, 1949 (38 of 1949) who has a valid certificate of practice under sub-section (1) of section 6 of the said Act.

* Chartered Accountant - Stated in clause (b) of sub-section (1) of section 2 of the Chartered Accountants Act, 1949 (38 of 1949) who has a valid certificate of practice under sub-section (1) of section 6 of the said Act.

Who Cannot Become an Auditor (Disqualifications)

The following list of individuals will not be considered eligible for appointment as the Auditor of a firm/company:

- A corporate body, i.e., a Company is not allowed to audit any other company. However, an LLP (limited liability partnership) can be an auditor.

- An individual or partner of the firm if:

- They are an employee or officer of the company being audited (Officer includes any manager, director, key managerial personnel, or any individual that directs or instructs the Board of Directors or one or more of the Directors are accustomed to act) .

- They are a partner of employee or officer of the company being audited.

- Their relative** is the Director, Key Managerial person, or an employee of the company being audited.

- They are a full-time employment elsewhere.

- They are convicted by a court for an offence involving fraud and a time duration of 10 years has not passed from the date of conviction.

- They or their relative** directly or indirectly, has business relationship with the company being audited or its holding company or its subsidiary company or any other subsidiary of the holding Co. and falls in any of the below categories:

- They hold shares or securities (relative can hold shares/securities up to INR 100,000 face value).

- They have taken up a loan from the company worth INR 500,000 or above.

- They have provided a guarantee or security in relation with the indebtedness of a third person for more than INR 100,000

Relative in relation to an individual means the following persons:

- Members of a same Hindu Undivided Family (HUF)

- Spouses

- Father (including Stepfather)

- Mother (including Stepmother)

- Daughter

- Daughter’s Husband

- Son (Including Stepson)

- Son’s Wife

- Brother (Including Stepbrother)

- Sister (Including Stepsister)

Limit on number of Audits: an individual or partner of a firm/company cannot be appointed as the Auditor if the person/partner at the date of such appointment or reappointment serves as auditor of not more than twenty companies. However, the following companies are not covered by the ceiling of twenty audits:

- One Person Companies (OPC)

- Dormant companies

- Small companies

- Private companies/firm with paid-up share capital equivalent to less than INR 100 Crore (1 Bn)

Appointment Of Auditors

1. First Auditor (i.e. the auditors for the financial year wherein the company came into existence)

- Government Company# – The first auditor will be appointed by the Comptroller and Auditor-General of India (CAG) within a period of 60 days from the date of registration of the company.

In case the CAG does not appoint within the said period, the Board of Directors of the company shall appoint such auditor within the next 30 days

In case the Board fails to appoint an auditor within the next 30 days, it must inform the members of the company. These members will then appoint an auditor within a period of 60 days at an extraordinary general meeting.

- Other than Government Company – The first auditor will be appointed by the Board of Directors within a period of 30 days from the date of registration of the company/firm.

In case the Board fails to appoint such an auditor, it must inform the members of the company who will appoint an auditor within a period of 90 days at an extraordinary general meeting (EGM).

In both types of Companies, the first Auditor will be responsible to hold office until the conclusion of the first annual general meeting.

#Government company means any company in which not less than fifty-one per cent. of the paid-up share capital is held by the Central Government (CG), or by any State Government(s) (SG) or Governments, or partly by the CG and partly by one or more SGs and includes a company which is a subsidiary company of such a government company and some other company owned or controlled, indirectly or directly, CG or any SGs.

2. Subsequent Auditor

- Government Company – The Comptroller and Auditor-General of India (CAG) will appoint a duly qualified auditor to be within a period of 180 days from the commencement of the financial year, who will hold office until the conclusion of the annual general meeting.

- Other than Government Company – at the first annual general meeting, the company shall select an individual/firm as the Auditor who will be responsible to hold office from the conclusion of the meeting till the conclusion of its 6th annual general meeting (AGM) and subsequently until the conclusion of every sixth meeting (i.e. Tenure of 5 years).

[Note: at every 6th AGM, a retiring auditor may be re-appointed at, if—

i. He/she is not disqualified for re-appointment.

ii. He/she has not provided notice in writing to the company of his/her unwillingness to be re-elected.

iii. A special resolution has not been passed at the said meeting, appointing another auditor or stating that he/she shall not be re-appointed.

If a situation arises at any AGM, wherein no auditor is appointed or re-appointed, the existing auditor will continue to be the auditor of the company.]

3. Documents required for appointment of Auditor:

- A written consent of the auditor for such an appointment

- Certificate from the Auditor submitting the below points:

i. The individual/firm is considered eligible for appointment and is not disqualified for appointment under the Companies Act or the Chartered Accountants Act, 1949 and the regulations lying therein.

ii. The proposed appointment adheres to the terms provided under the Companies Act, 2013

iii. The proposed appointment is well within the limits proposed by or under the authority of the Companies Act, 2013

iv. The list of proceedings against the auditor/audit firm/partner of the audit firm pending vis-a-vis professional matters, as indicated in the certificate, is true and correct.

4. The company is required to notify the concerned Auditor of its appointment, and also lodge a notice of such an appointment with the Registrar of Companies (ROC) within 15 days of the meeting wherein the auditor is appointed in form ADT-1

5. A company must form an Audit Committee under section 177, wherein every appointment, including the filling of a casual vacancy of an auditor shall be made after considering the recommendations of the Audit committee.

6. Rotation of Auditors (Maximum Tenure of Auditor): The company cannot appoint or reappoint:

- An individual as auditor for more than one term of five consecutive years.

- An audit firm as auditor for more than two terms of five consecutive years.

[Note The above ceiling of 5/10 years is applicable to only the following companies:

(i) The Companies/firms enlisted on a stock exchange in India.

(ii) All the public companies being unlisted with a paid-up share capital of INR 10 Crore (INR 100 Mn.) or more.

(iii) All the private limited companies with a paid-up share capital of INR 50 crore or (INR 500 Mn.) more.

(iv) All Companies with a record of public borrowings from financial institutions, banks, or public deposits of INR 50 crores (INR 500 Mn.) or more]

Casual Vacancy

- A casual Vacancy is created after the valid appointment of the Auditor. Following are some reasons due to which casual vacancy may be created:

a. Death of Auditor

b. Resignation of Auditor

c. Removal of Auditor by the company

d. The Auditor becomes disqualified due any of conditions mention in the article before

2. Filing up of Casual Vacancy

- Government Company – The vacancy must be filled by the Comptroller and Auditor-General of India within a period of 30 days of creation of casual Vacancy. If CAG finds an inability to fill the vacancy of an Auditor within the said period, the Board of Directors is required to fill the vacancy within the next 30 days.

- Other than Government Company – The vacancy shall be filled by the Board of Directors within 30 days. However, if the casual vacancy occurs due to the resignation of an auditor, such appointment will also be approved by the company/firm (i.e. shareholders) at a general meeting convened within 3 months of such appointment.

Prohibition On Rendering of Certain Services by Auditors

In accordance to the section 144 of the Companies Act, 2013, an appointed auditor shall provide only such other services to the company being audited as are approved by the Board of Directors or the audit committee (if Committee required), but any services shall not include the ones enlisted (whether provided directly or indirectly to the company/holding company/subsidiary company:

- Accounting and book-keeping services

- Internal audit

- Implementation and design of any financial information system

- Actuarial services

- Investment advisory services

- Investment banking services.

- Rendering of outsourced financial services.

- Management services.

If the Auditor provides the above-mentioned services, he shall incur disqualifications from being an auditor.

We can assist you with concerns related to auditing and the associated legal nuances. You can submit a query below and get in touch with us.